Timeline Rules

Are you ready to start an exchange today?

Timeline Rules

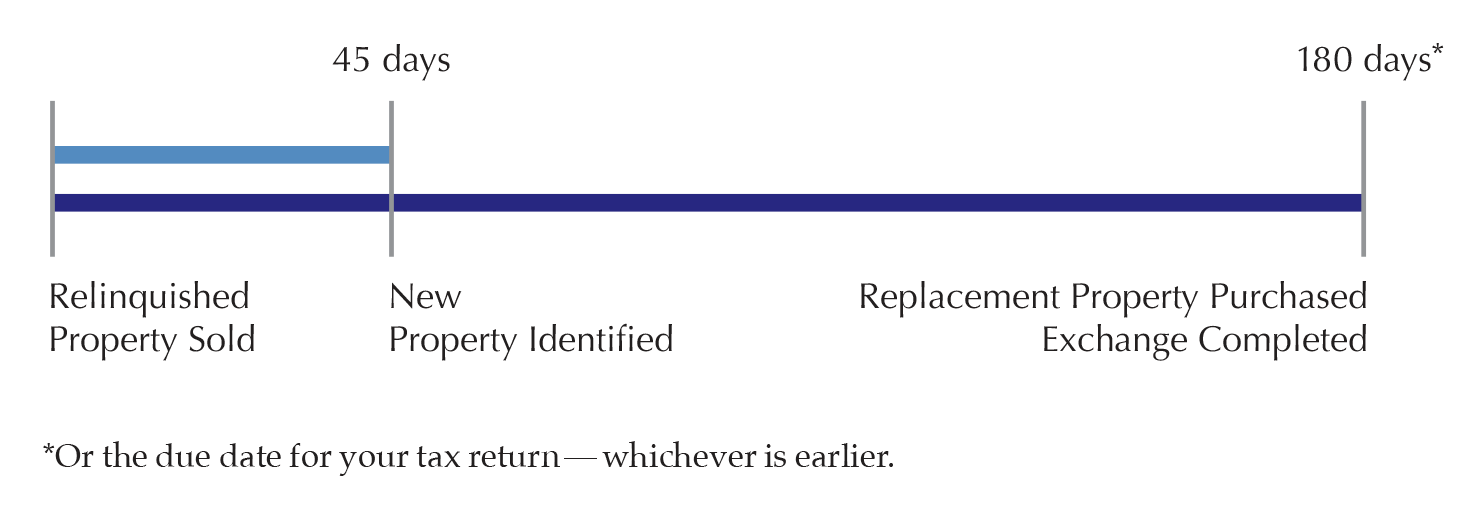

There are important timelines the exchangor must adhere to in order to complete a 1031 Exchange. The entire 1031 Exchange must be completed within 180 calendar days. This means the exchangor must close on all replacement properties within 180 days from selling their relinquish property. The exchangor must identify any potential replacement property during the first 45 calendar days of the exchange process. These deadlines are absolute and cannot be extended for any reason, unless otherwise stated by the IRS.

Feel free to utilize GB 1031’s free Timeline Calculator to calculate a potential 1031 Exchange Timeline.

Identification Rules

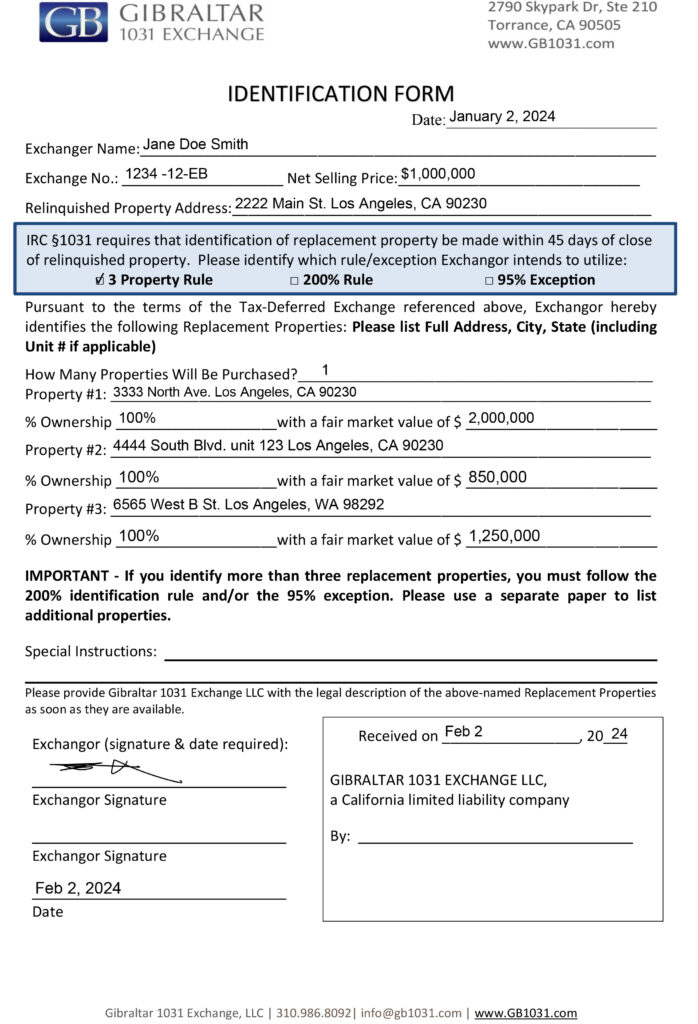

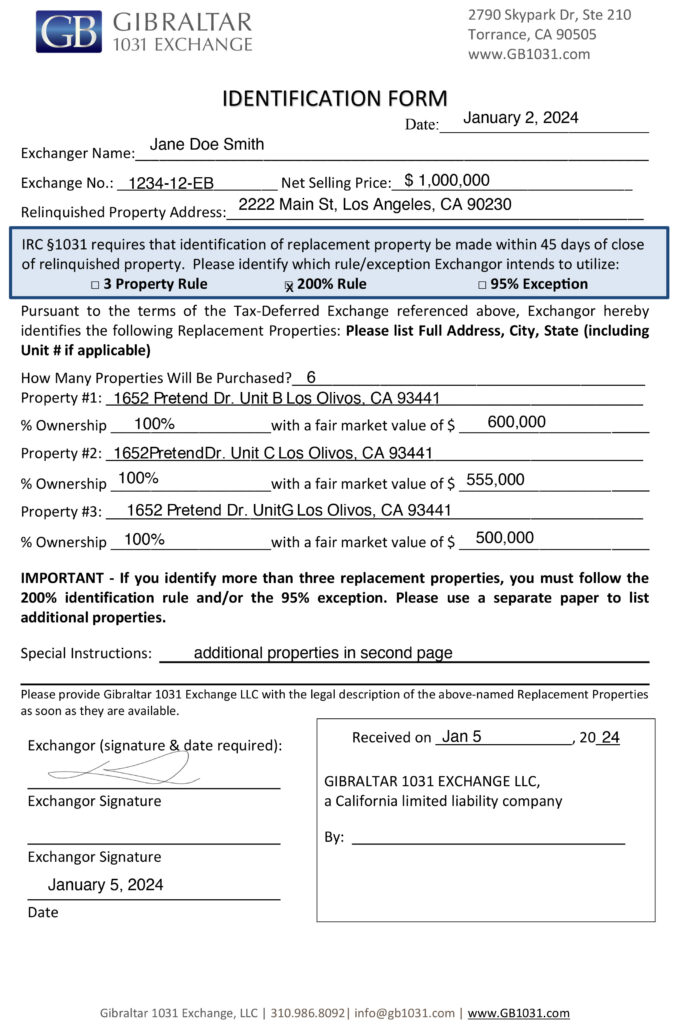

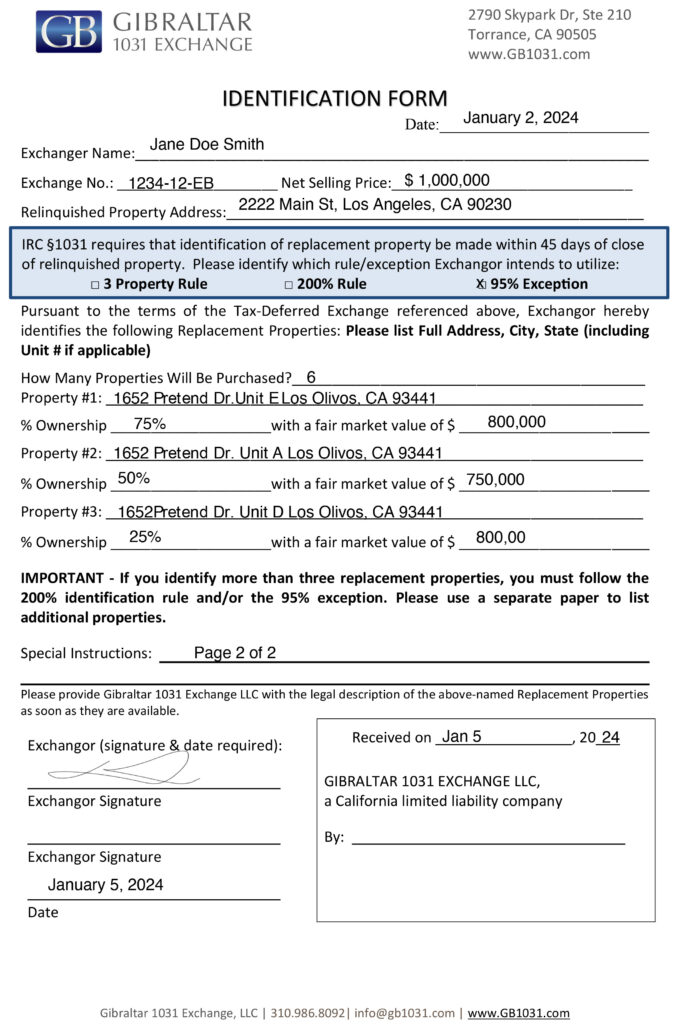

The taxpayer must identify any potential replacement property(s) within the identification period. This must be made in a written document. The written identification must be signed by the taxpayer and delivered to GB 1031 or any other person who is not a disqualified person and who is involved in the exchange.

This can simply be done by completing, signing and dating the Identification Form provided by GB 1031.

If the taxpayer fails to identify replacement properties within the identification period, the exchange will fail and the taxpayer will be subject to capital gains taxes on the sale of the relinquished property. Please note, the taxpayer can identify replacement properties at any time during the 45-day identification period. In addition, the taxpayer can amend their identification anytime within the identification period, as long as it is in writing and follows above protocols.

There are three available methods for identifying replacement property, however, only one method can be selected and used by a taxpayer in each 1031 Exchange.

3 Property Rule

The taxpayer can identify up to three replacement properties, regardless of their fair market value. The taxpayer is not required to purchase all three properties, but they must purchase at least one of the identified properties to defer capital gains taxes.

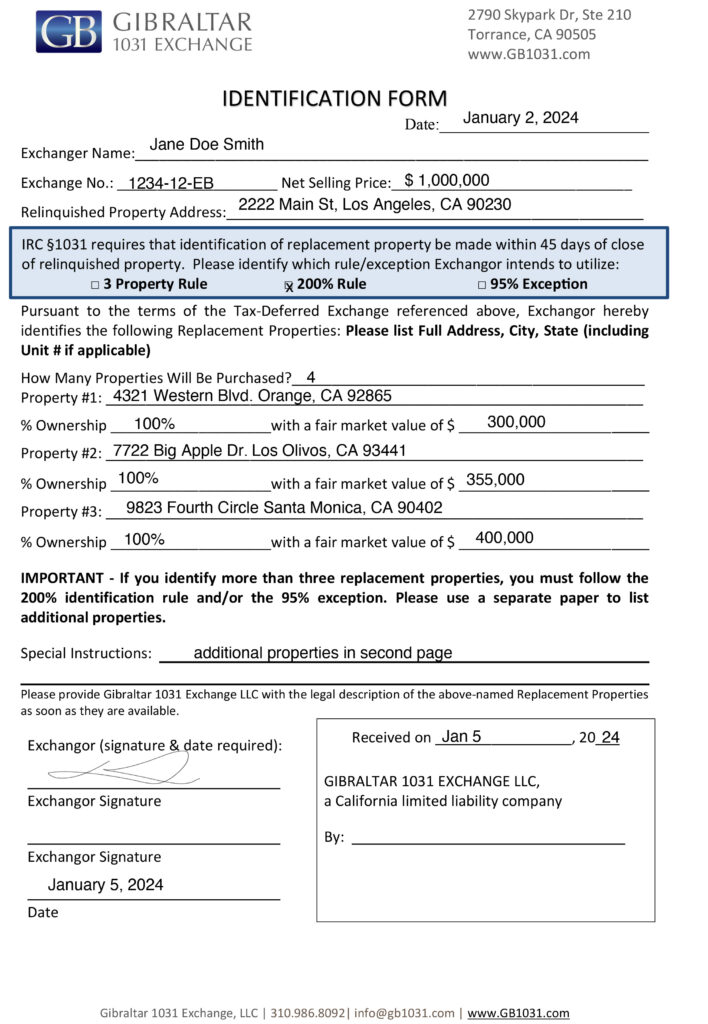

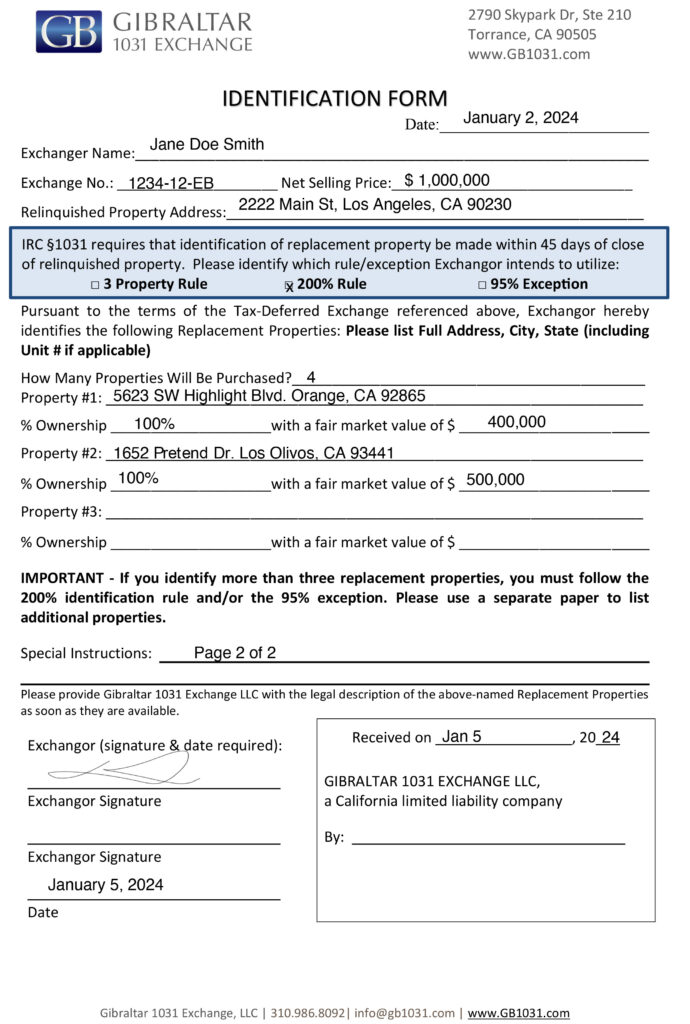

200% Rule

The 200% Rule limits the total fair market value of the replacement property(s) identified. The total fair market value of the properties identified using this identification rule cannot exceed 200% of the fair market value of the relinquished property.

The taxpayer is not required to purchase all properties identified, but they can only purchase a property(s) that they identified in order to defer capital gains taxes.

95% Exception

The 95% Exception rule allows the taxpayer to identify more than three replacement properties, for any total fair market value. However, the taxpayer must acquire at least 95% of the total fair market value of the identified properties to defer capital gains taxes.

Feel free to utilize GB 1031’s free Timeline Calculator to calculate a potential 1031 Exchange Timeline.